|

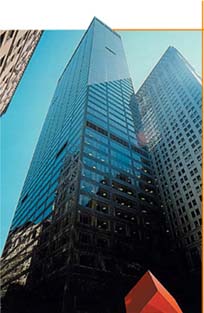

New York Architecture Images- Lower Manhattan HSBC BANK BUILDING |

|||||||

|

architect |

Gordon Bunschaft of Skidmore, Owings, and Merrill | |||||||

|

location |

140 Broadway, between Liberty and Cedar Streets. | |||||||

|

date |

1967 | |||||||

|

style |

International Style II | |||||||

|

construction |

||||||||

|

type |

Bank | |||||||

|

|

|

|||||||

|

images |

|

|||||||

|

|

|

|||||||

|

notes |

This 52 story, 1.2 million square foot world-class office tower is strategically located in the heart of Lower Manhattan's Financial District, just steps from the New York Stock Exchange. Since its acquisition in 1998, Silverstein Properties implemented an extensive restoration and beautification program to bring the building back to first-class status, including a new landscaped plaza, remodeled entrances, a thoroughly renovated lobby and new elevator cabs. The Building's classic center core construction featuring virtually column free floors, high ceilings and wraparound windows, provides tenants spectacular unspoiled river-to-river views. A typical floor measures approximately 24,000 rentable square feet. Major tenants include the world headquarters of Brown Brothers Harriman, and other prestigious tenants such as Computer Associates, UBS/Paine Webber, Atlantic Mutual Insurance and ACE USA, Inc.

America's oldest and largest privately-owned bank to occupy 430,000 Sq Ft at Silverstein/Morgan Stanley-owned building New York, NY -- (July 24, 2001) -- In a vote of confidence for the downtown Manhattan market, Brown Brothers Harriman & Co. will move from its address of 168 years at 59/63 Wall Street to 140 Broadway, where it will occupy 430,000 square feet in the 1.2-million square foot tower owned by Silverstein Properties, Inc. and its partner, Morgan Stanley Real Estate Fund III. Brown Brothers' commitment is significant because when HSBC vacated 140 Broadway earlier this year, there was concern in real estate circles about the negative impact such a large block of empty space could have on downtown. The concern intensified four months ago when potential tenant Goldman Sachs changed its plans and decided not to occupy the building. So the bank's decision to stay in New York and to remain downtown is a coup for the City as well as for the entire lower Manhattan community. Scott Gamber, a senior managing director with Insignia/ESG, and Douglas Lehman, from the firm's consulting group, negotiated the 20-year lease for Brown Brothers, the nation's oldest and largest privately-owned bank. Catherine Ernst and Roger Silverstein acted for Silverstein Properties and Morgan Stanley Real Estate Fund III. "It's a testament to the strength of the downtown market that Brown Brothers will remain in lower Manhattan," said Mr. Gamber who added that the bank certainly could have moved a large portion of its employees to New Jersey to join their technology and operations colleagues located at Newport Office Tower, in Jersey City, NJ. "But in efforts to retain such an important banking institution as Brown Brothers Harriman in New York, the City's Economic Development Corporation structured an incentive plan that kept these jobs in Manhattan. We're pleased to have accommodated one of the nation's most prestigious financial institutions at 140 Broadway, one of downtown's most prestigious office buildings." About 850 people will re-locate in Brown Brothers' move to 140 Broadway, built in 1967, from the bank's former home at 59/63 Wall Street, a 35-story 1929 property that was known for years as the Brown Brothers Harriman Building. The bank will occupy floors 1-20 and move-in is scheduled for next summer. "Brown Brothers Harriman & Co. has been located in the financial district since the firm opened an office in New York in 1825, and we are very pleased to have made this decision to remain in downtown New York City," said Radford W. Klotz, the partner at Brown Brothers who oversaw the negotiations. "The incentive package received from the New York City Economic Development Corporation was an important factor in our headquarters decision." He went on to say, "This architecturally significant building, designed by Gordon Bunschaft of Skidmore, Owings, and Merrill, will make an elegant and appropriate home for our firm, and we couldn't be happier with our new relationship with Silverstein Properties and the Morgan Stanley Real Estate Fund III, owners of the building." "It's yet another commitment of a prestigious investment banking firm with a long history in New York," said Larry Silverstein, President of Silverstein Properties. "They had many significant opportunities to go to other areas, and they decided to stay in the our city." Mr. Gamber conducted a thorough search of location alternatives for the bank whose 35-year lease at 59/63 Wall Street was due to expire in 2003. In addition to wanting a signature building, high on Brown Brothers' wish list was that the space be conducive to open-plan seating. Although 850 people are moving to 140 Broadway, only about ten will occupy private offices because Brown Brothers' philosophy is that partners should physically work among other colleagues. Architects Swanke Hayden Connell have been retained for the interior design of the new office space at 140 Broadway. The country's oldest and largest partnership owned bank, Brown Brothers Harriman currently operates in nine domestic and seven overseas locations with about 3,000 employees. In addition to a full range of Commercial Banking facilities, the firm is among the leading providers of the following financial services: Investment Management for Individuals and Institutions, Personal Trust & Estate Administration, Private Equity, Global Custody, Foreign Exchange, Merger and Acquisition Advice, and Securities Brokerage. For more information on BBH, please visit www.bbh.com. Insignia/ESG is one of the largest commercial real estate services providers in the United States, with comprehensive brokerage, consulting, property management, fee development, investment sales and debt placement operations. The company operates in top U.S. markets, including New York, Chicago, Los Angeles, Boston, Philadelphia, Atlanta, Miami, San Francisco, Dallas, Phoenix and Washington, D.C. Nationally, Insignia/ESG provides services for a property portfolio spanning approximately 230 million sq. ft. Insignia/ESG also delivers advanced commercial real estate services through Insignia Richard Ellis in the United Kingdom, and through other Insignia subsidiaries in Europe, Asia and Latin America. Insignia/ESG is a subsidiary of Insignia Financial Group, Inc., a publicly traded real estate company listed on the New York Stock Exchange under the symbol IFS.

|

|||||||